Quantre

Quantre is a Java application used to evaluate exposures in a typical interest bearing portfolio. It calculates various analytics, such as convexity and delta, on a variety of bond instruments, both those complying to BESA standards or various international standards. It works with normal bonds, zero coupon and stipped bonds, inflation linked bonds, retail debt, treasury bills and bonds issued in foreign currencies.

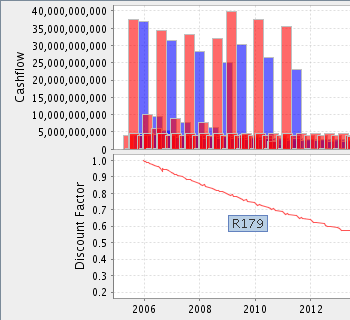

Quantre, together with the Ferra Econometric Model (FEM) was used to calculate the cost at risk (CAR) in the National Treasury's marketable and non-marketable debt exposures. For more Quantre screenshots, click here.